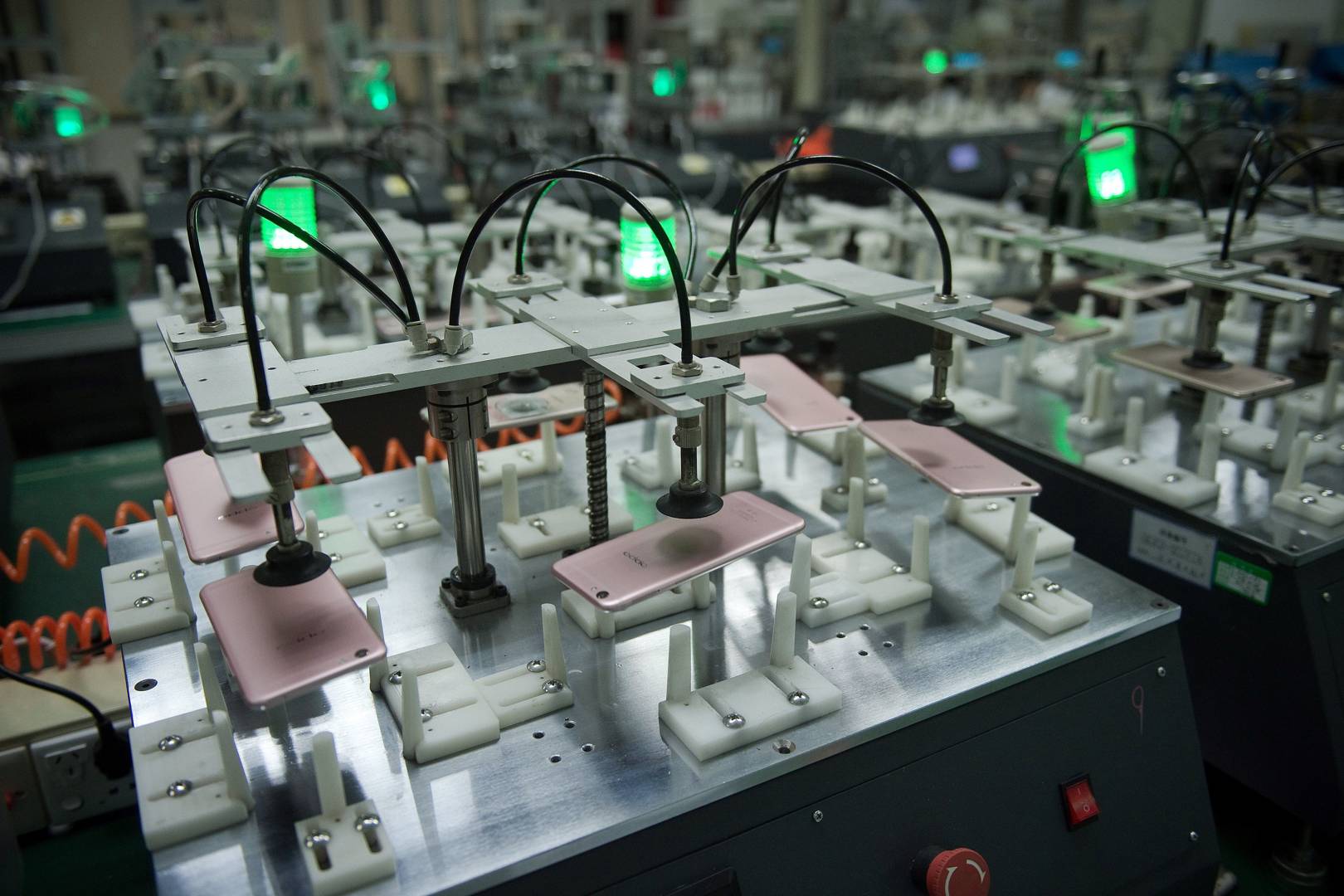

Getty Images / NICOLAS ASFOURI / Staff

For decades, China has been the world’s electronics manufacturing hub – but not for much longer. Google is the latest company to shift some of its production out of China, with reports stating it will be building its new Pixel 4 smartphone in an old Nokia factory in Vietnam.

It’s the latest company to move manufacturing out of China into Vietnam, where the manufacturing of computer, electronic and optical products has increased by a third since 2010, and electrical equipment has risen nine per cent in the same time period. The news was first reported by Nikkei.

“Fundamentally, the shift from China is a re-balancing of country risk,” says smartphone analyst Horace Dediu. “China’s dominance in production of consumer electronics, coupled with an authoritarian government, was never a stable arrangement. The political consequences are being felt in terms of a trade war but it would have surfaced some other way eventually.”

Some movement was already happening before the current US-China tensions, but the tariff war has put more urgency on brands to diversify production. That movement was the natural warp and weft of international trade. “From a supply chain perspective, things are never static and this is not just limited to tech,” says Creative Strategies’ smartphone analyst Carolina Milanesi. “If you look at clothing, for instance, we have seen a similar move from China to Indonesia.” And China benefitted from a shift of electronics manufacturing from Japan in the early 2000s, which itself became the electronics manufacturing hub after taking business from South Korea.

Companies’ concerns when picking places to make their goods include the price of manufacturing those items, the time it will take for them to ship the finished products to market, and also the diversification of the locations. However, the reason for this shift away from China isn’t down to cost alone – labour and manufacturing account for less than two per cent of the cost of a phone, says Dediu. “The value of China has been the skill sets in manufacturing operations and in engineering talent, and access to a network of suppliers that can act quickly and react to changing market conditions.”

Other fears include the risk of piracy or counterfeiting – which has long been an issue in China. “I do also wonder if the rise of local brands has put some pressure on capacity,” says Milanesi. While suppliers running factories that serve multiple electronics vendors have generally managed to avoid wide-scale counterfeiting – for instance Foxconn, which made Apple devices for years, kept a tight lid on its production – the rise of Chinese smartphone manufacturers makes the competitive market more difficult. Chinese factories could be diverted to produce phones for Chinese manufacturers.

The four largest Chinese smartphone makers – Huawei, Vivo, Oppo and Xiaomi – account for around 85 per cent of smartphone shipments in the country, according to data from analysts Canalys. Also, China is the world’s biggest smartphone market, and has been since 2013. Its factories are meeting demand from their own consumers, and have less time – and thanks to the bluster of Donald Trump, less inclination – to meet the world’s needs.

As a result, smartphone manufacturers are moving production south to Vietnam. The shift has been taking place for a while. A number of Samsung smartphones purchased over the last few years already bear the text ‘Made in Vietnam’ on their cover, where Samsung invested £1.8 billion into building a new factory in 2014. The South Korean smartphone company’s last factory in China, in Huizhou, stopped recruiting new employees in February 2019, and has laid off half its staff. Samsung is so big in Vietnam that one in every four dollars of Vietnam’s exports comes from Samsung products. According to The Economist, Vietnam’s labour force is half as expensive, and seven years younger on average, than China’s.

For those reasons many manufacturers are making Vietnam (or other countries) their new home. LG made a similar move out of South Korea, where it based its production, in April. Sony disappeared from Beijing in March, setting up shop in Thailand.

Every phone manufacturer that moves their business to Vietnam makes it more attractive for others to follow. “In many ways it’s due to the same reasons why China was attractive early-on,” says Dediu. “The cost of labour as an anchor, plus the flexibility and skill sets. Vietnam has been slowly gaining the skill sets necessary.”

More great stories from WIRED

🍔 World-class chef rates the best vegan burgers in the UK

😡 TikTok is fuelling India’s deadly hate speech epidemic

🍫 The foods you’ll really need to stockpile for no-deal Brexit

♻️ The truth behind the UK’s biggest recycling myths

🤷🏼 How is the internet still obsessed with Myers-Briggs?

read more at https://www.wired.co.uk/ by Chris Stokel-Walker

Tech